UpGate API documentation (v1.2)

Download OpenAPI specification:Download

UpGate is a world-class payment orchestration platform. Our mission is to simplify payments and make it easier for merchants to reach global customers. We use the latest technologies to help you achieve better conversions and global user monetization.

[1.1.34] - 2025-05-16

Added

- New response code '2120 Invalid amount'

- New fields processor_response_amount, processor_response_currency_code to postback transaction details

[1.1.33] - 2025-04-25

Added

- New response code '2908 Payment token is not valid'

[1.1.32] - 2025-04-14

Added

- New payment methods added

[1.1.31] - 2025-04-03

Added

- New fields rebill_transaction_amount, rebill_transaction_currency_code to transaction product postback & response

[1.1.30] - 2025-04-07

Added

- New payment methods added

[1.1.29] - 2025-03-05

Added

- New field customer_selected_country_code to postback payment details

[1.1.28] - 2025-02-24

Added

- New transaction types: RDR and RDR_REVERSAL

[1.1.27] - 2025-02-17

Added

- New fields customer_phone_number, customer_email, customer_first_name, customer_last_name, payment_token_type to postback payment details

- New fields processor_response_text, cascade_attempt, has_been_cascaded to postback transaction details

[1.1.26] - 2025-01-28

Added

- New response code '2907 Payment type not supported for payment method'

[1.1.25] - 2025-01-27

Changed

- Updated the page structure

[1.1.24] - 2025-01-15

Added

paymentFormOverrideobject was added to Checkout request- Override theme chapter

[1.1.23] - 2024-12-15

Added

- New response code '2309 Customer blacklisted'

[1.1.22] - 2024-11-26

Added

- Field version has been added to data in transaction postbacks

- Field version has been added to data in subscription postbacks

[1.1.21] - 2024-10-16

Removed

- Payment detail card_token_id has been removed from data.transactions.payment_details in postbacks

- Payment detail card_token_id has been removed from data.transactions.payment_details in response to synchronous mit-sale and mit-authorize

[1.1.20] - 2024-10-03

Changed

- Field payment_token_id as a required for MIT Sale Request and MIT Authorize Request

- Field methods as an optional field for Checkout Request

- Field shop_name max length from 64 to 128 characters in Checkout Request

- Field merchant_product_id max length from 64 to 128 characters in Checkout Request

Updated

[1.1.19] - 2024-09-17

Changed

- Changed max length for field success_url from 2048 to 512

- Changed max length for field failure_url from 2048 o 512

[1.1.18] - 2024-07-23

Added

- Added request subscription by transaction ID

[1.1.17] - 2024-04-12

Added

- Added Subscription state request by subscription id

[1.1.16] - 2024-04-10

Added

- For callback added fields transaction_amount, transaction_currency_code and product_transaction_price

[1.1.15] - 2024-04-04

Changed

- Update response codes

[1.1.14] - 2024-02-20

Added

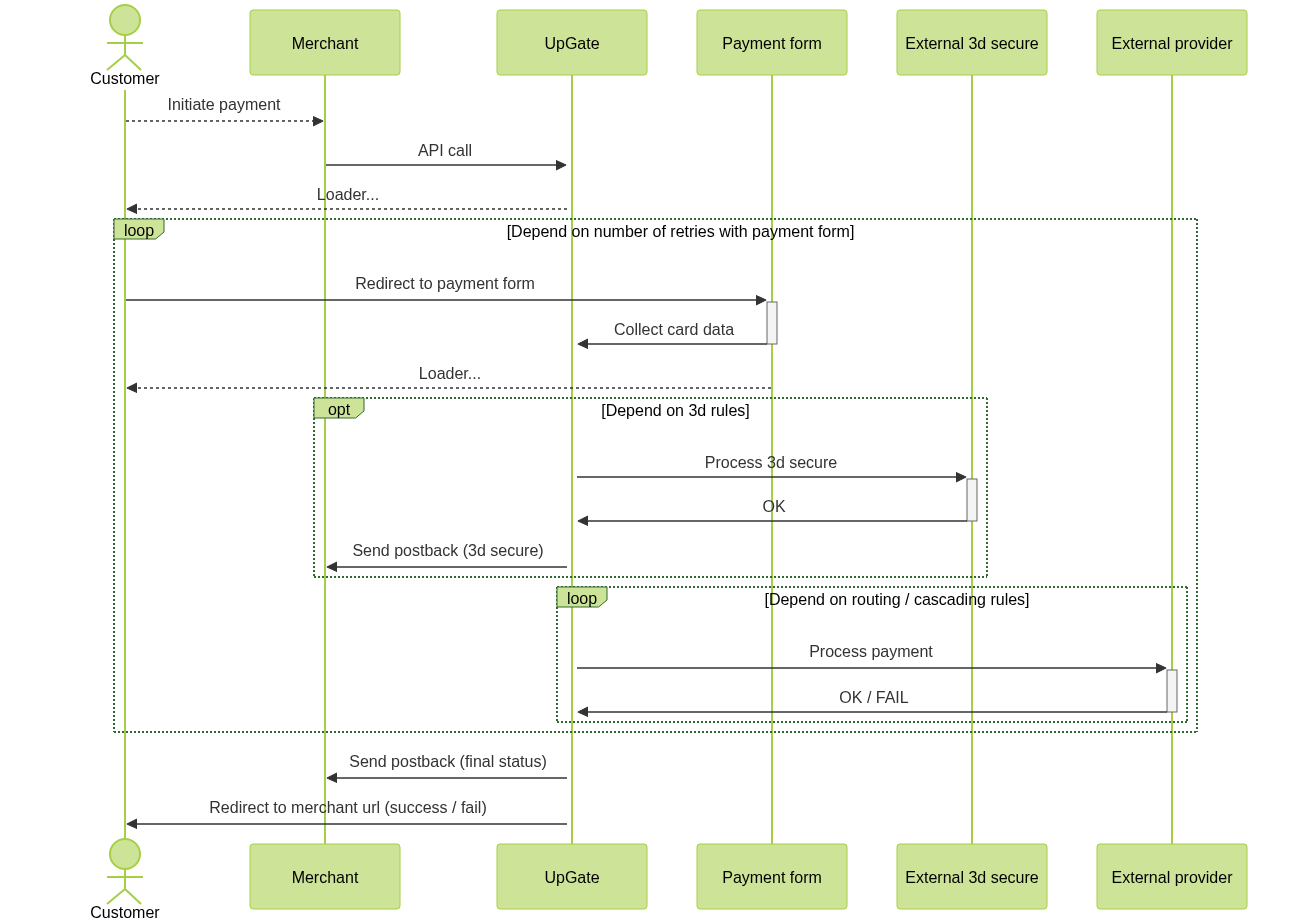

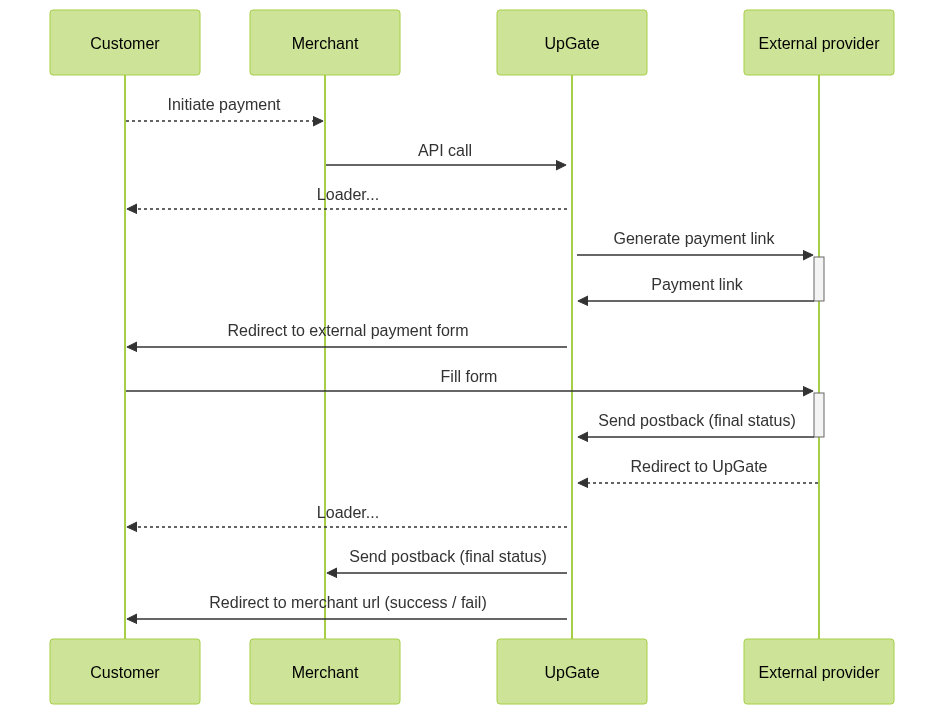

- Added Direct payment flow section

- Added Checkout flow section

- Added Checkout request examples

- Added description of Embedded flow for Checkout

- Added new APM payment methods

[1.1.13] - 2023-12-12

Added

- Added fields shop_name and shop_url

- For subscription added fields retry_at, retry_count and created_at

- Added new APM payment methods

Changed

- Update response codes

[1.1.12] - 2023-09-05

Added

- Create token endpoint

Changed

- Update response codes

[1.1.11] - 2023-03-05

Changed

- For subscription renamed field customer_id to merchant_customer_id

- For subscription renamed field is_enabled to is_rebill_enabled

- Changed max length for field success_url from 64 to 2048

- Changed max length for field failure_url from 64 to 2048

- Changed max length for field email from 64 to 320

- Changed that the amount for Authorize can be 0

Removed

- Required header X-Merchant-ID from all requests

URL for callback's (postback's) should be set with the merchant account (during the registration) & can be updated in any time using admin panel

| production | sandbox |

|---|---|

| 18.195.228.88 | 35.159.56.107 |

| 3.68.255.126 | 18.153.214.226 |

| 3.127.95.240 | 18.194.246.210 |

| 18.198.146.231 | 52.28.150.254 |

| status | description |

|---|---|

| SUCCESS | Transaction completed success |

| DECLINE | Transaction declined by some reason |

| ERROR | Some error were produced during the process |

| status |

|---|

| SALE |

| AUTHORIZE |

| THREE_DS |

| TOKEN |

| PAYOUT |

| REFUND |

| VOID |

| FRAUD_ALERT |

| CHARGEBACK |

| CHARGEBACK_REVERSAL |

| RDR |

| RDR_REVERSAL |

| code | message |

|---|---|

| 1000 | Success |

| 1200 | Pending |

| 1300 | 3DS verification successful (challenged) |

| 1301 | 3DS verification successful (frictionless) |

| 1302 | 3DS verification attempted |

| 1320 | 3DS verification denied |

| 1321 | 3DS could not be performed |

| 1322 | 3DS rejected by issuer |

| 1323 | 3DS invalid cardholder account number |

| 1324 | 3DS version not supported |

| 1325 | 3DS timeout |

| 1390 | 3DS integration error |

| 1400 | 3DS is required |

| 2000 | Decline |

| 2001 | Refer to card issuer |

| 2002 | Do not honor |

| 2003 | Bank decline |

| 2004 | Insufficient funds |

| 2005 | Card not supported |

| 2006 | Restricted card |

| 2007 | Over limit |

| 2008 | Merchant limit exceeded |

| 2009 | Invalid transaction |

| 2010 | Duplicate transaction |

| 2011 | transaction has already chargeback |

| 2012 | Crypto transaction decline |

| 2013 | Crypto insufficient funds |

| 2014 | Crypto smart contract insufficient funds |

| 2015 | Crypto transaction replaced |

| 2101 | Invalid CVV or expiry date |

| 2102 | CVV missing |

| 2103 | Invalid expiry date |

| 2120 | Invalid amount |

| 2130 | 3DS verification denied |

| 2131 | 3DS could not be performed |

| 2132 | 3DS rejected by issuer |

| 2133 | 3DS timeout |

| 2138 | 3DS SCA required |

| 2139 | 3DS integration error |

| 2140 | Low value rejected |

| 2141 | Incorrect card data |

| 2142 | Incorrect data |

| 2143 | Missing parameters |

| 2144 | 3DS version not supported |

| 2200 | Pick up card |

| 2201 | Pick up card (stolen or fraud) |

| 2202 | Expired card |

| 2203 | Unsupported card type |

| 2204 | No such issuer |

| 2205 | Decline by Card Scheme Advise Code |

| 2299 | Closed account |

| 2300 | Processor risk |

| 2301 | Velocity limit exceeded |

| 2302 | Suspected Fraud |

| 2309 | Customer blacklisted |

| 2310 | Card blacklisted |

| 2311 | IP blacklist |

| 2312 | Email blacklist |

| 2313 | BIN blacklist |

| 2314 | Country blacklist |

| 2315 | Fraud rule |

| 2900 | System malfunction |

| 2901 | Integration error |

| 2902 | Processor not supported feature |

| 2903 | Processor malfunction |

| 2904 | Timeout |

| 2905 | Refund is not supported for this method or transaction type |

| 2906 | Missing payment token |

| 2907 | Payment type not supported for payment method |

| 2908 | Payment token is not valid |

| 3000 | Unknown error |

| name |

|---|

| VISA |

| Mastercard |

| Maestro |

| Discover |

| Diners |

| UnionPay |

| RuPay |

| American Express |

| JCB |

| name |

|---|

| AIRCASH |

| AIRTEL |

| ALIPAY |

| ALIPAY_PLUS |

| BANK_APP |

| BANCONTACT |

| BINANCE_PAY |

| BLIK |

| BOLETO |

| CARDEXTERNAL |

| CODI |

| CRYPTO |

| DANA |

| EFECTY |

| EPS |

| GIROPAY |

| IDEAL |

| INSTANT_BANK_TRANSFER |

| KAKAO_PAY |

| KHIPU |

| LINKAJA |

| LOCAL_PAYMENT_METHODS |

| LOTERICA |

| MACH |

| MBWAY |

| MPESA |

| MULTIBANCO |

| MYBANK |

| NAVERPAY |

| NAVER_PAY |

| NUPAY |

| OVO |

| OXXOPAY |

| PAGOEFECTIVO |

| PAY_BY_BANK |

| PAY_BY_CASH |

| PAYCO |

| PAYCONIQ |

| PAYPAL |

| PAXUM |

| PICPAY |

| PIX |

| PSE |

| QRIS |

| SATISPAY |

| SEPA |

| SHOPEEPAY |

| SOFORT |

| SPEI |

| TODITO |

| TOSS |

| UPI |

| WIRE_TRANSFER |

Sale request

header Parameters

Request Body schema: application/jsonrequired

required | Payment data (object) or Payment data embedded (object) |

required | object |

required | object Specifies the URLs to which the customer will be redirected after completing a payment transaction. The success_url is used for redirection upon successful payment, and the failure_url is used in case of payment failure. |

required | Array of objects (checkoutProduct) |

object | |

object (paymentFormOverride) Customizing Payment Form Appearance. All these parameters will override existing configuration in Upgate back office if any |

OK

Request validation error

Authorization error

Too many requests error

Internal server error

- Payload

- curl

- Node.js

- JavaScript

{- "payment_data": {

- "merchant_payment_id": "P_001",

- "methods": [

- "CARD",

- "MBWAY"

], - "type": "SALE",

- "amount": 9.99,

- "currency_code": "EUR"

}, - "customer": {

- "merchant_customer_id": "U_001"

}, - "callback": {

}, - "products": [

- {

- "type": "SALE",

- "name": "Test product name",

- "description": "Test product description",

- "price": 9.99

}

]

}- 200

- 400

- 401

- 429

- 500

{- "id": "2E2CL5R3KC7K3",

- "created_at": "2022-04-15T10:54:03.633Z",

- "merchant_id": "upgatetests",

- "payment_data": {

- "merchant_payment_id": "P_001",

- "methods": [

- "CARD",

- "MBWAY"

], - "type": "SALE",

- "amount": 9.99,

- "currency_code": "EUR"

}, - "customer": {

- "merchant_customer_id": "U_001"

}, - "callback": {

}, - "products": [

- {

- "type": "SALE",

- "name": "Test product name",

- "description": "Test product description",

- "price": 9.99

}

], - "session": {

- "created_at": "2024-02-15T13:38:47.173Z",

- "expires_at": "2024-02-15T13:53:47.173Z",

}

}{- "type": "TRANSACTION",

- "data": {

- "transaction_id": "2E2CL7BTK23K3",

- "transaction_type": "SALE",

- "transaction_status": "SUCCESS",

- "created_at": "2022-05-13T12:24:37.094Z",

- "response_code": 1000,

- "response_text": "Success",

- "version": 1,

- "transaction_details": {

- "processor_merchant_account_id": "28148",

- "processor_transaction_id": "104335314",

- "processor": "PAYABL",

- "processor_response_code": "0",

- "processor_response_text": "Response text example",

- "cascade_attempt": "0",

- "has_been_cascaded": false,

- "arn": "331700997347"

}, - "payment_context": {

- "browser_user_agent": "PostmanRuntime/7.29.0",

- "browser_screen_height": "8",

- "browser_color_depth": "7",

- "browser_language": "6",

- "browser_timezone_offset": "10",

- "browser_screen_width": "9",

- "challenge_window_size": "04",

- "browser_has_js_enabled": "true",

- "browser_has_java_enabled": "true",

- "browser_accept_header": "*/*",

- "ip": "192.168.0.1"

}, - "payment_details": {

- "payment_token_id": "+wjPh608B8r2B2b3bG8IxARp6c1LqojODr/d19/ZPUE=",

- "card_scheme": "MASTERCARD",

- "card_bin": "523205",

- "card_last_four_digits": "0003",

- "customer_full_name": "John Doe",

- "customer_phone_number": "1234567890",

- "customer_email": "johndoe@gmail.com",

- "customer_first_name": "John",

- "customer_last_name": "Doe",

- "payment_token_type": "CARD",

- "card_expiry_month": "12",

- "card_expiry_year": "2024",

- "card_data_id": "2VNRH5IP22E24",

- "customer_selected_country_code": "GB"

}, - "payment": {

- "payment_id": "2E2CL5R3KC7K3",

- "payment_type": "SALE",

- "payment_method": "CARD",

- "created_at": "2022-04-15T10:54:03.633Z",

- "merchant_id": "UpGate",

- "merchant_payment_id": "P_001",

- "merchant_customer_id": "U_001",

- "email": "john_doe@upgate.com",

- "language": "en-us",

- "country_code": "US",

- "amount": "9.99",

- "currency_code": "USD",

- "transaction_amount": "7.87",

- "transaction_currency_code": "GBP",

- "transaction_fee_amount": "1.00",

- "transaction_fee_currency_code": "GBP",

- "base_amount": "9.46",

- "base_currency_code": "EUR",

- "forced_3d": false,

- "shop_name": "my shop",

- "initial_subscription_id": null,

- "products": [

- {

- "merchant_product_id": "R_001",

- "product_id": "2JZGULPNK27K2",

- "product_type": "SALE",

- "product_price": "9.99",

- "product_transaction_price": "7.87",

- "product_name": "Test product name",

- "product_description": "Test product description"

}

]

}

}

}Subscription request

header Parameters

Request Body schema: application/jsonrequired

required | object (subscriptionPaymentData) |

required | object |

required | object Specifies the URLs to which the customer will be redirected after completing a payment transaction. The success_url is used for redirection upon successful payment, and the failure_url is used in case of payment failure. |

required | Array of objects (subscriptionProduct) |

object | |

object (paymentFormOverride) Customizing Payment Form Appearance. All these parameters will override existing configuration in Upgate back office if any |

OK

Request validation error

Authorization error

Too many requests error

Internal server error

- Payload

- curl

- Node.js

- JavaScript

{- "payment_data": {

- "merchant_payment_id": "P_001",

- "methods": [

- "CARD",

- "MBWAY"

], - "type": "RECURRING",

- "amount": 9.99,

- "currency_code": "EUR"

}, - "customer": {

- "merchant_customer_id": "U_001"

}, - "callback": {

}, - "products": [

- {

- "type": "SUBSCRIPTION",

- "name": "Test product name",

- "description": "Test product description",

- "price": 9.99,

- "charge": {

- "value": 30,

- "interval": "DAY"

}

}

]

}- 200

- 400

- 401

- 429

- 500

{- "id": "2E2CL5R3KC7K3",

- "created_at": "2022-04-15T10:54:03.633Z",

- "merchant_id": "upgatetests",

- "payment_data": {

- "merchant_payment_id": "P_001",

- "methods": [

- "CARD",

- "MBWAY"

], - "type": "RECURRING",

- "amount": 9.99,

- "currency_code": "EUR"

}, - "customer": {

- "merchant_customer_id": "U_001"

}, - "callback": {

}, - "products": [

- {

- "type": "SUBSCRIPTION",

- "name": "Test product name",

- "description": "Test product description",

- "price": 9.99,

- "charge": {

- "value": 30,

- "interval": "DAY"

}

}

], - "session": {

- "created_at": "2024-02-15T13:38:47.173Z",

- "expires_at": "2024-02-15T13:53:47.173Z",

}

}{- "type": "TRANSACTION",

- "data": {

- "transaction_id": "2E2CL7BTK23K3",

- "transaction_type": "SALE",

- "transaction_status": "SUCCESS",

- "created_at": "2022-05-13T12:24:37.094Z",

- "response_code": 1000,

- "response_text": "Success",

- "version": 1,

- "transaction_details": {

- "processor_merchant_account_id": "28148",

- "processor_transaction_id": "104335314",

- "processor": "PAYABL",

- "processor_response_code": "0",

- "processor_response_text": "Response text example",

- "cascade_attempt": "0",

- "has_been_cascaded": false,

- "arn": "331700997347"

}, - "payment_context": {

- "browser_user_agent": "PostmanRuntime/7.29.0",

- "browser_screen_height": "8",

- "browser_color_depth": "7",

- "browser_language": "6",

- "browser_timezone_offset": "10",

- "browser_screen_width": "9",

- "challenge_window_size": "04",

- "browser_has_js_enabled": "true",

- "browser_has_java_enabled": "true",

- "browser_accept_header": "*/*",

- "ip": "192.168.0.1"

}, - "payment_details": {

- "payment_token_id": "+wjPh608B8r2B2b3bG8IxARp6c1LqojODr/d19/ZPUE=",

- "card_scheme": "MASTERCARD",

- "card_bin": "523205",

- "card_last_four_digits": "0003",

- "customer_full_name": "John Doe",

- "customer_phone_number": "1234567890",

- "customer_email": "johndoe@gmail.com",

- "customer_first_name": "John",

- "customer_last_name": "Doe",

- "payment_token_type": "CARD",

- "card_expiry_month": "12",

- "card_expiry_year": "2024",

- "card_data_id": "2VNRH5IP22E24",

- "customer_selected_country_code": "GB"

}, - "payment": {

- "payment_id": "2E2CL5R3KC7K3",

- "payment_type": "SALE",

- "payment_method": "CARD",

- "created_at": "2022-04-15T10:54:03.633Z",

- "merchant_id": "UpGate",

- "merchant_payment_id": "P_001",

- "merchant_customer_id": "U_001",

- "email": "john_doe@upgate.com",

- "language": "en-us",

- "country_code": "US",

- "amount": "9.99",

- "currency_code": "USD",

- "transaction_amount": "7.87",

- "transaction_currency_code": "GBP",

- "transaction_fee_amount": "1.00",

- "transaction_fee_currency_code": "GBP",

- "base_amount": "9.46",

- "base_currency_code": "EUR",

- "forced_3d": false,

- "shop_name": "my shop",

- "initial_subscription_id": null,

- "products": [

- {

- "merchant_product_id": "R_001",

- "product_id": "2JZGULPNK27K2",

- "product_type": "SALE",

- "product_price": "9.99",

- "product_transaction_price": "7.87",

- "product_name": "Test product name",

- "product_description": "Test product description"

}

]

}

}

}Update subscription by merchant product id

header Parameters

Request Body schema: application/jsonrequired

OK

Request validation error

Authorization error

Internal server error

- Payload

- curl

- Node.js

- JavaScript

{- "is_rebill_enabled": true

}- 200

- 400

- 401

- 500

{- "type": "SUBSCRIPTION",

- "data": {

- "subscription_id": "2JWZGUKDK2DK2",

- "created_at": "2023-02-15T16:11:50.694Z",

- "subscription_status": "ACTIVE",

- "expires_at": "2023-03-13T16:11:50.694Z",

- "merchant_id": "UpGate",

- "payment_id": "2E2CL5R3KC7K3",

- "product_id": "2JZGULPNK27K2",

- "merchant_product_id": "R_001",

- "merchant_payment_id": "P_001",

- "merchant_customer_id": "777",

- "payment_method": "CARD",

- "currency_code": "USD",

- "amount": "10.01",

- "is_trial": false,

- "charge_interval": "DAY",

- "charge_interval_value": 11,

- "is_rebill_enabled": true,

- "retry_at": "2023-03-13T16:11:50.694Z",

- "retry_count": 0,

- "retry_total_count": 2

}

}Get subscription by transaction ID

OK

Authorization error

Internal server error

- curl

- Node.js

- JavaScript

- 200

- 401

- 500

{- "type": "SUBSCRIPTION",

- "data": [

- {

- "subscription_id": "2JWZGUKDK2DK2",

- "created_at": "2023-02-15T16:11:50.694Z",

- "subscription_status": "ACTIVE",

- "expires_at": "2023-03-13T16:11:50.694Z",

- "merchant_id": "UpGate",

- "payment_id": "2E2CL5R3KC7K3",

- "product_id": "2JZGULPNK27K2",

- "merchant_product_id": "R_001",

- "merchant_payment_id": "P_001",

- "merchant_customer_id": "777",

- "payment_method": "CARD",

- "currency_code": "USD",

- "amount": "10.01",

- "is_trial": false,

- "charge_interval": "DAY",

- "charge_interval_value": 11,

- "is_rebill_enabled": true,

- "retry_at": "2023-03-13T16:11:50.694Z",

- "retry_count": 0,

- "retry_total_count": 2

}, - {

- "subscription_id": "2JWZGUKDK2DK9",

- "created_at": "2024-03-10T11:09:44.832Z",

- "subscription_status": "ACTIVE",

- "expires_at": "2024-09-10T11:09:44.832Z",

- "merchant_id": "UpGate",

- "payment_id": "2E2CL5R9KC7K0",

- "product_id": "2JZGULPRK27K1",

- "merchant_product_id": "R_002",

- "merchant_payment_id": "P_002",

- "merchant_customer_id": "777",

- "payment_method": "CARD",

- "currency_code": "USD",

- "amount": "111.50",

- "is_trial": false,

- "charge_interval": "DAY",

- "charge_interval_value": 11,

- "is_rebill_enabled": true,

- "retry_at": "2024-06-10T11:09:44.832Z",

- "retry_count": 0,

- "retry_total_count": 2

}

], - "meta": {

- "pageNumber": 1,

- "pageSize": 100

}

}Get subscription by subscription id

OK

Authorization error

Not found

Internal server error

- curl

- Node.js

- JavaScript

- 200

- 401

- 404

- 500

{- "type": "SUBSCRIPTION",

- "data": {

- "subscription_id": "2JWZGUKDK2DK2",

- "created_at": "2023-02-15T16:11:50.694Z",

- "subscription_status": "ACTIVE",

- "expires_at": "2023-03-13T16:11:50.694Z",

- "merchant_id": "UpGate",

- "payment_id": "2E2CL5R3KC7K3",

- "product_id": "2JZGULPNK27K2",

- "merchant_product_id": "R_001",

- "merchant_payment_id": "P_001",

- "merchant_customer_id": "777",

- "payment_method": "CARD",

- "currency_code": "USD",

- "amount": "10.01",

- "is_trial": false,

- "charge_interval": "DAY",

- "charge_interval_value": 11,

- "is_rebill_enabled": true,

- "retry_at": "2023-03-13T16:11:50.694Z",

- "retry_count": 0,

- "retry_total_count": 2

}

}Update subscription by subscription id

header Parameters

Request Body schema: application/jsonrequired

OK

Request validation error

Authorization error

Internal server error

- Payload

- curl

- Node.js

- JavaScript

{- "is_rebill_enabled": true

}- 200

- 400

- 401

- 500

{- "type": "SUBSCRIPTION",

- "data": {

- "subscription_id": "2JWZGUKDK2DK2",

- "created_at": "2023-02-15T16:11:50.694Z",

- "subscription_status": "ACTIVE",

- "expires_at": "2023-03-13T16:11:50.694Z",

- "merchant_id": "UpGate",

- "payment_id": "2E2CL5R3KC7K3",

- "product_id": "2JZGULPNK27K2",

- "merchant_product_id": "R_001",

- "merchant_payment_id": "P_001",

- "merchant_customer_id": "777",

- "payment_method": "CARD",

- "currency_code": "USD",

- "amount": "10.01",

- "is_trial": false,

- "charge_interval": "DAY",

- "charge_interval_value": 11,

- "is_rebill_enabled": true,

- "retry_at": "2023-03-13T16:11:50.694Z",

- "retry_count": 0,

- "retry_total_count": 2

}

}{- "type": "SUBSCRIPTION",

- "data": {

- "subscription_id": "2JWZGUKDK2DK2",

- "created_at": "2023-02-15T16:11:50.694Z",

- "subscription_status": "ACTIVE",

- "expires_at": "2023-03-13T16:11:50.694Z",

- "merchant_id": "UpGate",

- "payment_id": "2E2CL5R3KC7K3",

- "product_id": "2JZGULPNK27K2",

- "merchant_product_id": "R_001",

- "merchant_payment_id": "P_001",

- "merchant_customer_id": "777",

- "payment_method": "CARD",

- "currency_code": "USD",

- "amount": "10.01",

- "transaction_amount": "7.87",

- "is_trial": false,

- "charge_interval": "DAY",

- "charge_interval_value": 11,

- "is_rebill_enabled": true,

- "retry_at": "2023-03-13T16:11:50.694Z",

- "retry_count": 0,

- "retry_total_count": 2,

- "shop_name": "test shop",

- "initial_transaction_id": "2E2CL7BTK23K3",

- "version": 1

}

}Google Pay™ is a convenient and secure payment method that allows your customers to quickly and easily make purchases on your website.

To integrate Google Pay™ into Checkout form, we follow the guidelines specified in Google Pay Android brand guidelines or Google Pay Web brand guidelines.

To setup Google Pay™ into your website, follow these steps:

- Include the Google Pay™ method in the request as the payment method

{

"payment_data": {

"merchant_payment_id": "P_001",

"methods": ["CARD", "GOOGLE_PAY"],

"type": "SALE",

"amount": 9.99,

"currency_code": "EUR"

},

"customer": {

"merchant_customer_id": "U_001"

},

"callback": {

"success_url": "https://example.com/success",

"failure_url": "https://example.com/failure"

},

"products": [

{

"type": "SALE",

"name": "Test product name",

"description": "Test product description",

"price": 9.99

}

]

}

Configure Transaction Routing for Google Pay™ method, specify card schemes, currency and processor

Add information to your site that you support the Google Pay™ payment method and that you accept the terms defined in the Google Pay API Terms of Service.

Understand Google Pay Integration:

- Familiarize yourself with the Google Pay overview for websites documentation.

Integration Checklist for Web:

- Follow the Google Pay Integration Checklist to ensure all integration steps are covered.

- Check the Google Pay Developer Integration Checklist for additional details.

Brand Guidelines:

- Any references or referrals to Google Pay must comply with the brand guidelines for websites.

Configure Gateway Settings:

- Use the

"upgate"value for thegatewayproperty and enter your uniquegatewayMerchantId. To obtain yourgatewayMerchantId, contact our team at info@upgate.com. If you would like to use your own Google merchant id, you need to register for a merchant id at Google, refer to setup Google Account guide and send it to you team at info@upgate.com.

Billing Address Requirements:

- The customer billing address does not need to be sent if you use the UpGate Checkout page.

Accepted Payment Card Types:

- Google Pay outlines accepted payment card types in the Google Pay Tutorial.

Supported Card Networks:

- Depending on the processor, the international card networks Visa, MasterCard, Diners and American Express are supported.

3DS Authentication:

- Google Pay integration via the UpGate Checkout page supports processing with and without 3DS authentication. To use 3DS, enable 3DS for

"PAN_ONLY"and contact our team at info@upgate.com.

Authorization Methods by Country of Settlement:

- Default authorization methods are PAN_ONLY and 3DS (3-D Secure). For specific country requirements, contact our team at info@upgate.com.

The payment form offers visual customization options, enabling you to align its design with your website’s style. While the overall layout of each form remains consistent, you can adjust elements like colors, fonts, borders, padding, and more.

- Begin by selecting a theme.

- Adjust the theme using customizable variables.

- If necessary, refine specific components and states through theme rules.

In a checkout request, you can override the payment form settings configured in the back office by defining the payment_form_override object.

color: This property allows you to define payment button color.theme_type: This property allows you to define theme.theme_variables: This property enables you to override specific CSS variables to define custom styles for the payment form.theme_rules: This property allows you to define additional custom CSS rules to further tailor the design.

Begin customizing the payment form by selecting one of the available themes below:

- LIGHT

- DARK

- BROWSER

Note: BROWSER theme it's a automatically switch theme between LIGHT and DARK depends of system OS color scheme.

The theme_variables property is used to override default CSS variables of the payment form. This allows you to quickly and easily customize specific aspects of the design. The variables option functions similarly to CSS variables. You can assign CSS values to each variable and reference them using the var(--myVariable) syntax. Additionally, you can use your browser’s DOM explorer to inspect the applied styles in the resulting DOM.

Commonly used variables

| Variable | Description |

|---|---|

| primaryColor | Defines the primary color used across the application. |

| backgroundColor | Background color of the component. |

| formBackground | Background color of the form. |

| fontSizeBase | Base font size. |

| fontFamily | Font family used across the application. |

| loaderColor | Color for loader. |

Rest Variables

| Variable | Description |

|---|---|

| maxWidth | Maximum width of the container or component. |

| primaryColorHover | Primary color when hovered. |

| primaryColorActive | Primary color when active. |

| payBtnColor | Color of the payment button. |

| payBtnColorDisabled | Color of the payment button when disabled. |

| payBtnFontSize | Font size for the payment button. |

| payBtnLineHeight | Line height for the payment button. |

| payBtnPadding | Padding for the payment button. |

| textColor | Default color for text. |

| formBorderColor | Border color for forms. |

| formPadding | Padding inside forms. |

| formBorderRadius | Border radius for forms. |

| m_formPadding | Mobile-specific padding for forms. |

| inputBackground | Background color for input fields. |

| inputBorderColor | Border color for input fields. |

| inputBorderColorHover | Border color for input fields when hovered. |

| inputBorderColorFocus | Border color for input fields when focused. |

| inputBorderColorError | Border color for input fields in error state. |

| inputBorderWidth | Border width for input fields. |

| inputBorderWidthHover | Border width for input fields when hovered. |

| inputBorderWidthFocus | Border width for input fields when focused. |

| inputBorderWidthError | Border width for input fields in error state. |

| borderRadius | Border radius applied across components. |

| inputPadding | Padding for input fields. |

| inputFontSize | Font size for input fields. |

| inputLineHeight | Line height for input fields. |

| inputFontWeight | Font weight for input fields. |

| placeHolderColor | Color for placeholder text in input fields. |

| cardBackground | Background color for cards. |

| cardBorderColor | Border color for cards. |

| cardBorderRadius | Border radius for cards. |

| cardPadding | Padding for cards. |

| cardSelectColorSelected | Color of selected card during selection. |

| inputIconColor | Color of icons inside input fields. |

| descriptionColor | Color for descriptive text. |

| dividerColor | Color of dividers or separators. |

| fontSizeXl | Font size for extra-large text. |

| fontSizeLg | Font size for large text. |

| fontSizeSm | Font size for small text. |

| fontSizeXs | Font size for extra-small text. |

| fontSize2Xs | Font size for ultra-small text. |

| lineHeight | Line height for text. |

| fontCss | Custom CSS applied to fonts. |

| lineHeightXl | Line height for extra-large text. |

| lineHeightLg | Line height for large text. |

| fontWeight | General font weight for text. |

| buttonPadding | Padding for buttons. |

| buttonFontWeight | Font weight for button text. |

| buttonBackground | Background color for buttons. |

| buttonFontSize | Font size for buttons. |

| buttonLineHeight | Line height for button text. |

| buttonColor | Text color for buttons. |

| buttonBackgroundHover | Background color for buttons when hovered. |

| buttonColorHover | Text color for buttons when hovered. |

| buttonBackgroundActive | Background color for buttons when active. |

| buttonColorActive | Text color for buttons when active. |

| linkColor | Color for hyperlinks. |

| fontWeightLight | Font weight for lighter text styles. |

| fontWeightMedium | Font weight for medium text styles. |

| fontWeightBold | Font weight for bold text styles. |

| labelFontSize | Font size for labels. |

| labelLineHeight | Line height for labels. |

| labelFontWeight | Font weight for labels. |

| labelColor | Color for labels. |

| errorColor | Color for error messages or indicators. |

| selectBackgroundHover | Background color for select elements when hovered. |

| selectBackgroundActive | Background color for select elements when active. |

| cardSelectDeleteColor | Color for delete option in card selection. |

| transitionDuration | Duration for transition effects. |

| transitionStyle | Style for transition effects. |

| buttonOutlineColor | Outline color for buttons. |

| buttonOutlineBorderColor | Border color for button outlines. |

| buttonOutlineBorderWidth | Border width for button outlines. |

| buttonOutlineBackgroundHover | Background color for outlined buttons when hovered. |

| buttonOutlineBackgroundActive | Background color for outlined buttons when active. |

| tabBorderRadius | Border radius for tabs. |

| tabPadding | Padding for tabs. |

| tabHeight | Height for tabs. |

| tabColor | Text color for tabs. |

| tabBackground | Background color for tabs. |

| tabBorderColor | Border color for tabs. |

| tabBorderColorActive | Border color for tabs when active. |

| tabBackgroundActive | Background color for tabs when active. |

| tabColorSelected | Text color for selected tabs. |

| tabBackgroundSelected | Background color for selected tabs. |

| tabBorderColorSelected | Border color for selected tabs. |

| tabBorderColorHover | Border color for tabs when hovered. |

| tabBackgroundHover | Background color for tabs when hovered. |

| tabBorderWidth | Border width for tabs. |

| tabBorderWidthHover | Border width for tabs when hovered. |

| tabBorderWidthActive | Border width for tabs when active. |

| tabBorderWidthSelected | Border width for selected tabs. |

| tabFontWeight | Font weight for tabs. |

| tabFontWeightSelected | Font weight for selected tabs. |

| languageSelectColor | Color for language selection dropdown. |

| subscriptionColor | Color used for subscription-related text or buttons. |

| subscriptionFontSize | Font size for subscription-related text. |

| subscriptionLineHeight | Line height for subscription-related text. |

| subscriptionFontWeight | Font weight for subscription-related text. |

| buttonColorDisabled | Text color for disabled buttons. |

| buttonBackgroundDisabled | Background color for disabled buttons. |

| footerColor | Color of text in the footer. |

| footerIconColor | Color of icons in the footer. |

| footerFontWeight | Font weight for text in the footer. |

| footerFontSize | Font size for text in the footer. |

| footerLineHeight | Line height for text in the footer. |

| footerPadding | Padding for the footer. |

| m_footerPadding | Mobile-specific padding for the footer. |

| badgeFontSize | Font size for badges. |

| badgeBackground | Background color for badges. |

| badgeColor | Text color for badges. |

| methodIconWidth | Width for payment method icons. |

| methodIconHeight | Height for payment method icons. |

| iconSize | General size for icons. |

| searchInputBackground | Background color for search inputs. |

| searchInputBackgroundHover | Background color for search inputs when hovered. |

| messageInfoColor | Text color for informational messages. |

| messageInfoBorderColor | Border color for informational messages. |

| messageInfoBackground | Background color for informational messages. |

| messageErrorColor | Text color for error messages. |

| messageErrorBorderColor | Border color for error messages. |

| messageErrorBackground | Background color for error messages. |

| currencySelectBackground | Background color for the currency select. |

| currencySelectBorderColor | Border color for the currency select. |

| currencySelectIndicatorBackground | Background color for the indicator in the currency select. |

| currencySelectIndicatorBorderRadius | Border radius for the indicator in the currency select. |

The theme_rules option is a mapping of CSS-like selectors to CSS properties, enabling precise customization of individual components. Once you’ve defined your theme and variables, you can use these rules to seamlessly align the payment form with your website’s design.

Selectors in a rule can target any public class names within the payment form, as well as supported states, pseudo-classes, and pseudo-elements associated with each class. For example, the following are valid selectors: .form-control > input

MIT Sale request

header Parameters

Request Body schema: application/jsonrequired

| payment_token_id required | string [ 1 .. 64 ] characters Token from original payment |

| payment_method required | string |

| merchant_payment_id | string [ 1 .. 64 ] characters Optional field, might be used as a reference from the merchant side |

| merchant_customer_id required | string [ 1 .. 64 ] characters |

| email required | string [ 1 .. 320 ] characters |

| amount required | string^\d{1,18}(?:\.\d{1,2})?$ can't be zero for SALE | MIT_SALE |

| language | string^[a-z]{2}-[a-z]{2}$ required only for SALE | AUTHORIZE | RECURRING |

| country_code required | string^[A-Z]{2}$ Country Code (ISO 3166-2) |

| currency_code required | string^[A-Z]{3}$ Currency code (ISO 4217) |

| forced_3d | boolean Default: false If needs to initiate 3d secure from merchant side. |

| success_url | string <url> [ 1 .. 512 ] characters required only for SALE | AUTHORIZE | RECURRING |

| failure_url | string <url> [ 1 .. 512 ] characters required only for SALE | AUTHORIZE | RECURRING |

| shop_name | string [ 1 .. 128 ] characters Shop name |

| shop_url | string [ 1 .. 128 ] characters Shop URL with protocol HTTP or HTTPS |

required | Array of productSale (object) or productSubscription (object) [ 0 .. 10 ] items Expected at least 1 product |

object (paymentFormOverride) Customizing Payment Form Appearance. All these parameters will override existing configuration in Upgate back office if any |

OK

Request validation error

Authorization error

Too many requests error

Internal server error

- Payload

- curl

- Node.js

- JavaScript

{- "payment_method": "CARD",

- "merchant_payment_id": "P_001",

- "merchant_customer_id": "U_001",

- "amount": "9.99",

- "currency_code": "USD",

- "email": "john_doe@upgate.com",

- "country_code": "US",

- "payment_token_id": "+wjPh608B8r2B2b3bG8IxARp6c1LqojODr/d19/ZPUE=",

- "shop_name": "my shop",

- "products": [

- {

- "merchant_product_id": "R_001",

- "product_type": "SALE",

- "product_price": "9.99",

- "product_name": "Test product name",

- "product_description": "Test product description"

}

]

}- 200

- 400

- 401

- 429

- 500

{- "type": "PAYMENT",

- "data": {

- "payment_id": "2E2CL5R3KC7K3",

- "payment_type": "MIT_SALE",

- "payment_method": "CARD",

- "created_at": "2022-04-15T10:54:03.633Z",

- "merchant_id": "UpGate",

- "merchant_payment_id": "P_001",

- "merchant_customer_id": "U_001",

- "email": "john_doe@upgate.com",

- "amount": "9.99",

- "country_code": "US",

- "base_amount": "9.46",

- "base_currency_code": "EUR",

- "currency_code": "USD",

- "payment_token_id": "+wjPh608B8r2B2b3bG8IxARp6c1LqojODr/d19/ZPUE=",

- "shop_name": "my shop",

- "products": [

- {

- "merchant_product_id": "R_001",

- "product_id": "2JZGULPNK27K2",

- "product_type": "SALE",

- "product_price": "9.99",

- "product_name": "Test product name",

- "product_description": "Test product description"

}

]

}

}{- "type": "TRANSACTION",

- "data": {

- "transaction_id": "2E2CL7BTK23K3",

- "transaction_type": "SALE",

- "transaction_status": "SUCCESS",

- "created_at": "2022-05-13T12:24:37.094Z",

- "response_code": 1000,

- "response_text": "Success",

- "version": 1,

- "transaction_details": {

- "processor_merchant_account_id": "28148",

- "processor_transaction_id": "104335314",

- "processor": "PAYABL",

- "processor_response_code": "0",

- "processor_response_text": "Response text example",

- "cascade_attempt": "0",

- "has_been_cascaded": false,

- "arn": "331700997347"

}, - "payment_details": {

- "payment_token_id": "+wjPh608B8r2B2b3bG8IxARp6c1LqojODr/d19/ZPUE=",

- "card_scheme": "MASTERCARD",

- "card_bin": "523205",

- "card_last_four_digits": "0003",

- "customer_full_name": "John Doe",

- "customer_phone_number": "1234567890",

- "customer_email": "johndoe@gmail.com",

- "customer_first_name": "John",

- "customer_last_name": "Doe",

- "payment_token_type": "CARD",

- "card_expiry_month": "12",

- "card_expiry_year": "2024",

- "card_data_id": "2VNRH5IP22E24"

}, - "payment": {

- "payment_id": "2E2CL5R3KC7K3",

- "payment_type": "MIT_SALE",

- "payment_method": "CARD",

- "created_at": "2022-04-15T10:54:03.633Z",

- "merchant_id": "UpGate",

- "merchant_payment_id": "P_001",

- "merchant_customer_id": "U_001",

- "email": "john_doe@upgate.com",

- "country_code": "US",

- "amount": "9.99",

- "currency_code": "USD",

- "transaction_amount": "7.87",

- "transaction_currency_code": "GBP",

- "transaction_fee_amount": "1.99",

- "transaction_fee_currency_code": "GBP",

- "base_amount": "9.46",

- "base_currency_code": "EUR",

- "payment_token_id": "+wjPh608B8r2B2b3bG8IxARp6c1LqojODr/d19/ZPUE=",

- "shop_name": "my shop",

- "initial_subscription_id": null,

- "products": [

- {

- "merchant_product_id": "R_001",

- "product_id": "2JZGULPNK27K2",

- "product_type": "SALE",

- "product_price": "9.99",

- "product_transaction_price": "7.87",

- "product_name": "Test product name",

- "product_description": "Test product description"

}

]

}

}

}Recurring transaction

header Parameters

Request Body schema: application/jsonrequired

| payment_method required | string |

| merchant_payment_id | string [ 1 .. 64 ] characters Optional field, might be used as a reference from the merchant side |

| merchant_customer_id required | string [ 1 .. 64 ] characters |

| email required | string [ 1 .. 320 ] characters |

| amount required | string^\d{1,18}(?:\.\d{1,2})?$ can't be zero for SALE | MIT_SALE |

| language | string^[a-z]{2}-[a-z]{2}$ required only for SALE | AUTHORIZE | RECURRING |

| country_code required | string^[A-Z]{2}$ Country Code (ISO 3166-2) |

| currency_code required | string^[A-Z]{3}$ Currency code (ISO 4217) |

| forced_3d | boolean Default: false If needs to initiate 3d secure from merchant side. |

| success_url | string <url> [ 1 .. 512 ] characters required only for SALE | AUTHORIZE | RECURRING |

| failure_url | string <url> [ 1 .. 512 ] characters required only for SALE | AUTHORIZE | RECURRING |

| shop_name | string [ 1 .. 128 ] characters Shop name |

| shop_url | string [ 1 .. 128 ] characters Shop URL with protocol HTTP or HTTPS |

required | Array of productSale (object) or productSubscription (object) [ 0 .. 10 ] items Expected at least 1 product |

object (paymentFormOverride) Customizing Payment Form Appearance. All these parameters will override existing configuration in Upgate back office if any |

OK

Request validation error

Authorization error

Too many requests error

Internal server error

- Payload

- curl

- Node.js

- JavaScript

{- "payment_method": "CARD",

- "merchant_payment_id": "P_001",

- "merchant_customer_id": "U_001",

- "amount": "9.99",

- "currency_code": "USD",

- "email": "john_doe@upgate.com",

- "language": "en-us",

- "country_code": "US",

- "forced_3d": false,

- "shop_name": "my shop",

- "products": [

- {

- "merchant_product_id": "R_001",

- "product_type": "SUBSCRIPTION",

- "product_price": "9.99",

- "product_name": "Test product name",

- "product_description": "Test product description",

- "charge_interval": "DAY",

- "charge_interval_value": 30,

- "is_trial": false

}

]

}- 200

- 400

- 401

- 429

- 500

{- "type": "PAYMENT",

- "data": {

- "payment_id": "2JWYCAOYS67K2",

- "payment_type": "RECURRING",

- "payment_method": "CARD",

- "created_at": "2023-03-02T14:51:50.779Z",

- "merchant_id": "UpGate",

- "merchant_payment_id": "P_001",

- "merchant_customer_id": "U_001",

- "amount": "9.99",

- "currency_code": "USD",

- "base_amount": "9.46",

- "base_currency_code": "EUR",

- "email": "john_doe@upgate.com",

- "language": "en-us",

- "country_code": "US",

- "forced_3d": true,

- "shop_name": "my shop",

- "session": {

- "created_at": "2023-03-02T14:51:50.779Z",

- "expires_at": "2023-03-02T15:06:50.779Z",

}, - "products": [

- {

- "merchant_product_id": "R_001",

- "product_id": "2JZGULPNK27K2",

- "product_type": "SUBSCRIPTION",

- "product_price": "9.99",

- "product_name": "Test product name",

- "product_description": "Test product description",

- "charge_interval": "DAY",

- "charge_interval_value": 30,

- "rebill_transaction_amount": "9.99",

- "rebill_transaction_currency_code": "USD",

- "rebill_transaction_fee_amount": "1.00",

- "rebill_transaction_fee_currency_code": "USD",

- "is_trial": false

}

]

}

}{- "type": "TRANSACTION",

- "data": {

- "transaction_id": "2E2CL7BTK23K3",

- "transaction_type": "SALE",

- "transaction_status": "SUCCESS",

- "created_at": "2022-05-13T12:24:37.094Z",

- "response_code": 1000,

- "response_text": "Success",

- "version": 1,

- "transaction_details": {

- "processor_merchant_account_id": "28148",

- "processor_transaction_id": "104335314",

- "processor": "PAYABL",

- "processor_response_code": "0",

- "processor_response_text": "Response text example",

- "cascade_attempt": "0",

- "has_been_cascaded": false,

- "arn": "331700997347"

}, - "payment_context": {

- "browser_user_agent": "PostmanRuntime/7.29.0",

- "browser_screen_height": "8",

- "browser_color_depth": "7",

- "browser_language": "6",

- "browser_timezone_offset": "10",

- "browser_screen_width": "9",

- "challenge_window_size": "04",

- "browser_has_js_enabled": "true",

- "browser_has_java_enabled": "true",

- "browser_accept_header": "*/*",

- "ip": "192.168.0.1"

}, - "payment_details": {

- "payment_token_id": "+wjPh608B8r2B2b3bG8IxARp6c1LqojODr/d19/ZPUE=",

- "card_scheme": "MASTERCARD",

- "card_bin": "523205",

- "card_last_four_digits": "0003",

- "customer_full_name": "John Doe",

- "customer_phone_number": "1234567890",

- "customer_email": "johndoe@gmail.com",

- "customer_first_name": "John",

- "customer_last_name": "Doe",

- "payment_token_type": "CARD",

- "card_expiry_month": "12",

- "card_expiry_year": "2024",

- "card_data_id": "2VNRH5IP22E24",

- "customer_selected_country_code": "GB"

}, - "payment": {

- "initial_subscription_id": "2E2CL5M3KC7K3",

- "payment_id": "2E2CL5R3KC7K3",

- "payment_type": "RECURRING",

- "payment_method": "CARD",

- "created_at": "2022-04-15T10:54:03.633Z",

- "merchant_id": "UpGate",

- "merchant_payment_id": "P_001",

- "merchant_customer_id": "U_001",

- "email": "john_doe@upgate.com",

- "language": "en-us",

- "amount": "9.99",

- "country_code": "US",

- "transaction_amount": "7.87",

- "transaction_currency_code": "GBP",

- "transaction_fee_amount": "1.99",

- "transaction_fee_currency_code": "GBP",

- "currency_code": "USD",

- "base_amount": "9.46",

- "base_currency_code": "EUR",

- "forced_3d": true,

- "shop_name": "my shop",

- "products": [

- {

- "merchant_product_id": "R_001",

- "product_id": "2JZGULPNK27K2",

- "product_type": "SUBSCRIPTION",

- "product_price": "9.99",

- "product_transaction_price": "7.98",

- "product_name": "Test product name",

- "product_description": "Test product description",

- "charge_interval": "DAY",

- "charge_interval_value": 30,

- "rebill_transaction_amount": "9.99",

- "rebill_transaction_currency_code": "USD",

- "rebill_transaction_fee_amount": "1.99",

- "rebill_transaction_fee_currency_code": "USD",

- "is_trial": false

}

]

}

}

}Token request

Request to create token

Request Body schema: application/jsonrequired

OK

Request validation error

Authorization error

Too many requests error

Internal server error

- Payload

- curl

- Node.js

- JavaScript

{- "payment_method": "CARD",

- "merchant_payment_id": "P_001",

- "merchant_customer_id": "U_001",

- "email": "john_doe@upgate.com",

- "language": "en-us",

- "country_code": "US",

- "prefilled_card_holder": "John Doe",

}- 200

- 400

- 401

- 429

- 500

{- "type": "PAYMENT",

- "data": {

- "payment_id": "2E2CL5R3KC7K3",

- "payment_type": "TOKEN",

- "payment_method": "CARD",

- "created_at": "2022-04-15T10:54:03.633Z",

- "merchant_id": "UpGate",

- "merchant_payment_id": "P_001",

- "merchant_customer_id": "U_001",

- "email": "john_doe@upgate.com",

- "language": "en-us",

- "country_code": "US",

- "prefilled_card_holder": "John Doe",

- "shop_name": "my shop",

- "session": {

- "created_at": "2022-04-15T10:54:03.633Z",

- "expires_at": "2022-04-15T11:09:03.633Z",

}

}

}{- "type": "TRANSACTION",

- "data": {

- "transaction_id": "2E2CL7BTK23K3",

- "transaction_type": "TOKEN",

- "transaction_status": "SUCCESS",

- "created_at": "2022-05-13T12:24:37.094Z",

- "response_code": 1000,

- "response_text": "Success",

- "version": 1,

- "payment_context": {

- "browser_user_agent": "PostmanRuntime/7.29.0",

- "browser_screen_height": "8",

- "browser_color_depth": "7",

- "browser_language": "6",

- "browser_timezone_offset": "10",

- "browser_screen_width": "9",

- "challenge_window_size": "04",

- "browser_has_js_enabled": "true",

- "browser_has_java_enabled": "true",

- "browser_accept_header": "*/*",

- "ip": "192.168.0.1"

}, - "payment_details": {

- "payment_token_id": "+wjPh608B8r2B2b3bG8IxARp6c1LqojODr/d19/ZPUE=",

- "card_scheme": "MASTERCARD",

- "card_bin": "523205",

- "card_last_four_digits": "0003",

- "customer_full_name": "John Doe",

- "customer_phone_number": "1234567890",

- "customer_email": "johndoe@gmail.com",

- "customer_first_name": "John",

- "customer_last_name": "Doe",

- "payment_token_type": "CARD",

- "card_expiry_month": "12",

- "card_expiry_year": "2024",

- "card_data_id": "2VNRH5IP22E24"

}, - "payment": {

- "payment_id": "2E2CL5R3KC7K3",

- "payment_type": "TOKEN",

- "payment_method": "CARD",

- "created_at": "2022-05-13T12:24:30.854Z",

- "merchant_id": "UpGate",

- "merchant_customer_id": "U_001",

- "merchant_payment_id": "P_001",

- "email": "john_doe@upgate.com",

- "country_code": "CY",

- "language": "en-cy",

- "shop_name": "my shop",

- "payment_token_id": "+wjPh608B8r2B2b3bG8IxARp6c1LqojODr/d19/ZPUE=",

- "initial_subscription_id": null

}

}

}Payout request

header Parameters

Request Body schema: application/jsonrequired

OK

Request validation error

Authorization error

Internal server error

- Payload

- curl

- Node.js

- JavaScript

{- "payment_method": "CARD",

- "merchant_payment_id": "P_001",

- "merchant_customer_id": "U_001",

- "amount": "9.99",

- "currency_code": "USD",

- "payment_details": {

- "payment_token_id": "+wjPh608B8r2B2b3bG8IxARp6c1LqojODr/d19/ZPUE="

}

}- 200

- 400

- 401

- 500

{- "type": "PAYMENT",

- "data": {

- "payment_id": "2E2CL5R3KC7K3",

- "payment_type": "PAYOUT",

- "payment_method": "CARD",

- "created_at": "2022-04-15T10:54:03.633Z",

- "merchant_id": "UpGate",

- "merchant_payment_id": "P_001",

- "merchant_customer_id": "U_001",

- "amount": "9.99",

- "currency_code": "USD",

- "base_currency_code": "EUR",

- "base_amount": "9.46",

- "payment_details": {

- "payment_token_id": "+wjPh608B8r2B2b3bG8IxARp6c1LqojODr/d19/ZPUE="

}

}

}{- "type": "TRANSACTION",

- "data": {

- "transaction_id": "2E2CL7BTK23K3",

- "transaction_type": "PAYOUT",

- "transaction_status": "SUCCESS",

- "created_at": "2022-05-13T12:24:37.094Z",

- "response_code": 1000,

- "response_text": "Success",

- "transaction_details": {

- "processor_merchant_account_id": "28148",

- "processor_transaction_id": "104335314",

- "processor": "TRUSTPAY",

- "processor_response_code": "0",

- "processor_response_text": "Response text example",

- "processor_response_amount": "9.99",

- "processor_response_currency_code": "USD",

- "cascade_attempt": "0",

- "has_been_cascaded": false,

- "arn": "331700997347"

}, - "payment_context": {

- "browser_user_agent": "PostmanRuntime/7.29.0",

- "browser_screen_height": "8",

- "browser_color_depth": "7",

- "browser_language": "6",

- "browser_timezone_offset": "10",

- "browser_screen_width": "9",

- "challenge_window_size": "04",

- "browser_has_js_enabled": "true",

- "browser_has_java_enabled": "true",

- "browser_accept_header": "*/*",

- "ip": "192.168.0.1"

}, - "payment_details": {

- "payment_token_id": "+wjPh608B8r2B2b3bG8IxARp6c1LqojODr/d19/ZPUE="

}, - "payment": {

- "payment_id": "2E2CL5R3KC7K3",

- "payment_type": "PAYOUT",

- "payment_method": "CARD",

- "created_at": "2022-04-15T10:54:03.633Z",

- "merchant_id": "UpGate",

- "merchant_payment_id": "P_001",

- "merchant_customer_id": "U_001",

- "amount": "9.99",

- "currency_code": "USD",

- "transaction_amount": "9.99",

- "transaction_currency_code": "USD",

- "base_amount": "9.46",

- "base_currency_code": "EUR"

}

}

}Sale request (deprecated)

header Parameters

Request Body schema: application/jsonrequired

| payment_method required | string |

| merchant_payment_id | string [ 1 .. 64 ] characters Optional field, might be used as a reference from the merchant side |

| merchant_customer_id required | string [ 1 .. 64 ] characters |

| email required | string [ 1 .. 320 ] characters |

| amount required | string^\d{1,18}(?:\.\d{1,2})?$ can't be zero for SALE | MIT_SALE |

| language | string^[a-z]{2}-[a-z]{2}$ required only for SALE | AUTHORIZE | RECURRING |

| country_code required | string^[A-Z]{2}$ Country Code (ISO 3166-2) |

| currency_code required | string^[A-Z]{3}$ Currency code (ISO 4217) |

| forced_3d | boolean Default: false If needs to initiate 3d secure from merchant side. |

| success_url | string <url> [ 1 .. 512 ] characters required only for SALE | AUTHORIZE | RECURRING |

| failure_url | string <url> [ 1 .. 512 ] characters required only for SALE | AUTHORIZE | RECURRING |

| shop_name | string [ 1 .. 128 ] characters Shop name |

| shop_url | string [ 1 .. 128 ] characters Shop URL with protocol HTTP or HTTPS |

required | Array of productSale (object) or productSubscription (object) [ 0 .. 10 ] items Expected at least 1 product |

object (paymentFormOverride) Customizing Payment Form Appearance. All these parameters will override existing configuration in Upgate back office if any |

OK

Request validation error

Authorization error

Too many requests error

Internal server error

- Payload

- curl

- Node.js

- JavaScript

{- "payment_method": "CARD",

- "merchant_payment_id": "P_001",

- "merchant_customer_id": "U_001",

- "amount": "9.99",

- "currency_code": "USD",

- "email": "john_doe@upgate.com",

- "language": "en-us",

- "country_code": "US",

- "forced_3d": true,

- "shop_name": "my shop",

- "products": [

- {

- "merchant_product_id": "R_001",

- "product_type": "SALE",

- "product_price": "9.99",

- "product_name": "Test product name",

- "product_description": "Test product description"

}

]

}- 200

- 400

- 401

- 429

- 500

{- "type": "PAYMENT",

- "data": {

- "payment_id": "2E2CL5R3KC7K3",

- "payment_type": "SALE",

- "payment_method": "CARD",

- "created_at": "2022-04-15T10:54:03.633Z",

- "merchant_id": "UpGate",

- "merchant_payment_id": "P_001",

- "merchant_customer_id": "U_001",

- "email": "john_doe@upgate.com",

- "amount": "9.99",

- "language": "en-us",

- "country_code": "US",

- "currency_code": "USD",

- "base_amount": "9.46",

- "base_currency_code": "EUR",

- "forced_3d": true,

- "shop_name": "my shop",

- "session": {

- "created_at": "2022-04-15T10:54:03.633Z",

- "expires_at": "2022-04-15T11:09:03.633Z",

}, - "products": [

- {

- "merchant_product_id": "R_001",

- "product_id": "2JZGULPNK27K2",

- "product_type": "SALE",

- "product_price": "9.99",

- "product_name": "Test product name",

- "product_description": "Test product description"

}

]

}

}{- "type": "TRANSACTION",

- "data": {

- "transaction_id": "2E2CL7BTK23K3",

- "transaction_type": "SALE",

- "transaction_status": "SUCCESS",

- "created_at": "2022-05-13T12:24:37.094Z",

- "response_code": 1000,

- "response_text": "Success",

- "version": 1,

- "transaction_details": {

- "processor_merchant_account_id": "28148",

- "processor_transaction_id": "104335314",

- "processor": "PAYABL",

- "processor_response_code": "0",

- "processor_response_text": "Response text example",

- "cascade_attempt": "0",

- "has_been_cascaded": false,

- "arn": "331700997347"

}, - "payment_context": {

- "browser_user_agent": "PostmanRuntime/7.29.0",

- "browser_screen_height": "8",

- "browser_color_depth": "7",

- "browser_language": "6",

- "browser_timezone_offset": "10",

- "browser_screen_width": "9",

- "challenge_window_size": "04",

- "browser_has_js_enabled": "true",

- "browser_has_java_enabled": "true",

- "browser_accept_header": "*/*",

- "ip": "192.168.0.1"

}, - "payment_details": {

- "payment_token_id": "+wjPh608B8r2B2b3bG8IxARp6c1LqojODr/d19/ZPUE=",

- "card_scheme": "MASTERCARD",

- "card_bin": "523205",

- "card_last_four_digits": "0003",

- "customer_full_name": "John Doe",

- "customer_phone_number": "1234567890",

- "customer_email": "johndoe@gmail.com",

- "customer_first_name": "John",

- "customer_last_name": "Doe",

- "payment_token_type": "CARD",

- "card_expiry_month": "12",

- "card_expiry_year": "2024",

- "card_data_id": "2VNRH5IP22E24",

- "customer_selected_country_code": "GB"

}, - "payment": {

- "payment_id": "2E2CL5R3KC7K3",

- "payment_type": "SALE",

- "payment_method": "CARD",

- "created_at": "2022-04-15T10:54:03.633Z",

- "merchant_id": "UpGate",

- "merchant_payment_id": "P_001",

- "merchant_customer_id": "U_001",

- "email": "john_doe@upgate.com",

- "language": "en-us",

- "country_code": "US",

- "amount": "9.99",

- "currency_code": "USD",

- "transaction_amount": "7.87",

- "transaction_currency_code": "GBP",

- "transaction_fee_amount": "1.00",

- "transaction_fee_currency_code": "GBP",

- "base_amount": "9.46",

- "base_currency_code": "EUR",

- "forced_3d": false,

- "shop_name": "my shop",

- "initial_subscription_id": null,

- "products": [

- {

- "merchant_product_id": "R_001",

- "product_id": "2JZGULPNK27K2",

- "product_type": "SALE",

- "product_price": "9.99",

- "product_transaction_price": "7.87",

- "product_name": "Test product name",

- "product_description": "Test product description"

}

]

}

}

}Embedded components for checkout refer to a collection of ready-made user interface elements designed to facilitate the construction of your checkout process..

Set up the server:

- Install the packages (axios, express in example code) and import them in your code.

npm install axios express

- Add an endpoint on your server that creates a checkout.

Setup checkout parameters and set

success_urlandfailure_urlfor redirect customer. Createindex.jsfile with code bellow:

const express = require("express");

const axios = require("axios");

const PORT = 5000;

const YOUR_DOMAIN = `http://localhost:${PORT}`;

const API_KEY = "X-api-key";

const app = express();

app.use(express.static("public"));

app.post("/checkout", async (req, res) => {

const result = await axios.post(

"https://api.sandbox.upgate.com/v1/checkout",

{

payment_data: {

ui_mode: "EMBEDDED",

type: "SALE",

methods: ["CARD", "GIROPAY", "MBWAY"],

amount: "20.03",

currency_code: "EUR",

},

customer: {

merchant_customer_id: "test",

},

callback: {

success_url: `${YOUR_DOMAIN}/index.html?success=true`,

failure_url: `${YOUR_DOMAIN}/index.html`,

},

products: [

{

type: "SALE",

price: 55,

name: "Test product name for SALE",

description: "Test product description for SALE",

},

],

},

{

headers: {

"X-Api-Key": API_KEY,

"Content-Type": "application/json",

},

}

);

res.json({ url: result.data.session.redirect_url });

});

app.listen(PORT, () => console.log(`Running on port ${YOUR_DOMAIN}`));

Build a checkout page on the client

Load Upgate.js

Leverage Upgate.js to maintain PCI compliance by ensuring that payment information is transmitted directly to Upgate without accessing your server. To stay compliant, consistently load Upgate.js from js.upgate.com. Avoid incorporating the script into a bundle or hosting it independently. Create./publicfolder and createindex.htmlwith code below:

<html lang="en">

<head>

<script type="module" src="https://js.upgate.com/upgate.js"></script>

<script type="module" src="/main.js"></script>

<style>

body {

min-height: 100vh;

justify-content: center;

width: 350px;

margin: 0 auto;

display: flex;

flex-direction: column;

gap: 32px;

}

</style>

</head>

<body>

<div id="payment"></div>

<button id="buy" onclick="submit()">Buy</button>

</body>

</html>

Mount Checkout element

Upon loading your checkout page, promptly initiate a request to the endpoint on your server to generate a new Checkout. The URL provided by your endpoint is utilized for rendering the embedded checkout element. Create a CheckoutElement and mount it to the element<div id="payment">in your payment form. This incorporates an iframe containing a dynamic form that showcases configured payment method types available from the Checkout, enabling your customer to choose a payment method. The form autonomously gathers the relevant payment details for the chosen payment method type. Createmain.jsfile with code below in./publicfolder:

let upgate;

const elementId = "payment";

async function mount() {

const { url } = await fetch("/checkout", { method: "POST" }).then((res) =>

res.json()

);

upgate.mountPaymentElement(elementId, url);

upgate.onResult(elementId, console.log); // use this method for handle result

}

function submit() {

upgate.submit(elementId);

}

window.onload = async () => {

upgate = new Upgate();

mount();

};

Invoke submit('%elementId%'), providing the CheckoutElement and a success_url to specify the destination where Upgate should redirect the user upon completing the payment.

For payments necessitating authentication, Upgate presents a modal for 3D Secure authentication or directs the customer to an authentication page, contingent on the payment method utilized.

Following the completion of the authentication process, the customer is redirected to the specified success_url.

Handle response after submit

Pass callback parameter inupgate.onResultfunction for handleTResulttype object.

export type TResult = {

success: boolean;

url?: string;

error_message?: string;

error_code?: number;

retry?: boolean;

};

All types of Upgate.js you can find in index.d.ts.

- If

success: true- payment processed successful. - If

success: false; retry: false- payment was not processed, and form must be unmounted withunmountPaymentElement('payment'). - If

retry: true; success: falseyou can submit same form again (form not valid for example). - If payment was failed user will be redirected to

failure_urlwith query parameters?error_code=&error_message=

Config payment form

In mountPaymentElement function you can pass third config parameter.

declare type TConfig = Partial<{

theme?: "LIGHT" | "DARK" | "BROWSER";

onTimeout?: () => void;

}>;

Property theme overrides theme type defined in back office, and you can call embedded form with dynamically changed theme.

Callback onTimeout will call when form time limit exceed. After timeout you need to remount component.

Theme type BROWSER renders theme depending on system theme.

upgate.mountPaymentElement("%elementId%", "%checkoutUrl%", { theme: "LIGHT" });

After 15 minutes, a timeout will occur in the checkout process. The handling differs based on whether the form is embedded or non-embedded:

- For non-embedded form, when the checkout session times out, the user will be redirected to the failure URL.

- For embedded form for handle form timeout you can use timeout callback in mount config:

upgate.mountPaymentElement("%elementId%", "%checkoutUrl%", {

theme: "LIGHT",

onTimeout: handleTimeOutFn,

});

Or call onTimeout method after mount with timeout handler function as a parameter:

upgate.onTimeout("%elementId%", handleTimeOutFn);

When timeout handler was called you need to remount payment element.

When using the embedded form, the display of errors for customers is managed by the merchant. The table below provides examples of the text we, as the UpGate provider, recommend using for each code to enhance customers experience.

Table of Decline Codes and Messages

| code | message |

|---|---|

| 2000 | Your transaction was declined. Please try again or use another card. |

| 2001, 2002, 2003 | Your transaction was declined by your bank. Please try again or use another card. |

| 2004 | Your card has insufficient funds. Please try again or use another card. |

| 2005, 2006, 2203 | Your card is not supported. Please try again or use another card. |

| 2007 | Your card has exceeded its limit. Please check your card and try again or use another card. |

| 2008, 2009, 2010, 2900, 2901 | An error occurred while processing your card. Try again in a little bit. |

| 2101, 2102 | Your card's security code is incorrect. Please try again or use another card. |

| 2130, 2131, 2132, 2138, 2139, 2140, 1320, 1321, 1322, 1390 | Your 3-D Secure authentication failed. Please try again or use another card. |

| 2202 | Your card has expired. Please try again or use another card. |

| 2204, 2299 | Your card number is invalid. Please check the card number and try again or use another card. |

| other codes | Your card has been declined. Please try again or use another card. |